Kevin Davey's Recommended Futures Trading & Algo Trading Strategy Books

UPDATED February 2024

Discover the favorite trading books, algo trading books, trading psychology trading books and futures trading books of Champion trade Kevin Davey.

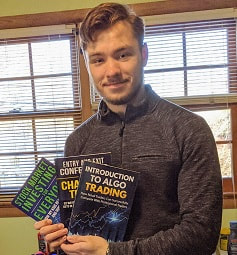

Kevin Davey's Algo Trading Books - All 5 Of My Bestselling Trading & Investing Books |

Best Algorithmic Trading Books - Serious Books For Serious Algo Traders |

Best Trading Books - My Favorite General Trading Books |

Best Trading Psychology Books - Great Books For Dealing With Trading Emotions |

Best Trading Idea Books - Tons Of Useful Ideas For Algo Testing |

Trading Industry Endorsements of Kevin Davey - What Trading Legends And Verified Champion Traders Say |