BUILD ALGO TRADING STRATEGIES WITH TRADESTATION

Receive My Strategy Factory Course For Free** -

With Unique Tradestation Rebate Program!

UPDATED - January 2023

CONTENTS

Chapter 1 - What Is Tradestation Automated Software?

Chapter 2 - What Is A Tradestation Strategy?

Chapter 3 - How Do I Create Trading Strategies, And What Can I Do With Them?

Chapter 4 - What Is Backtesting In Tradestation? Everything You Need to Know About Backtesting on TradeStation

Chapter 5 - What Is A Tradestation Automated Trading System? A Comprehensive Tutorial

Chapter 6 - What Is A Tradestation Indicator?

Chapter 7 - Entering Orders in Tradestation

Chapter 8 - Putting It All Together - What All Can You Do With Tradestation

Chapter 9 - Tradestation Vs The Competition

Chapter 10 - The Final Word On Tradestation

CONTENTS

Chapter 1 - What Is Tradestation Automated Software?

Chapter 2 - What Is A Tradestation Strategy?

Chapter 3 - How Do I Create Trading Strategies, And What Can I Do With Them?

Chapter 4 - What Is Backtesting In Tradestation? Everything You Need to Know About Backtesting on TradeStation

Chapter 5 - What Is A Tradestation Automated Trading System? A Comprehensive Tutorial

Chapter 6 - What Is A Tradestation Indicator?

Chapter 7 - Entering Orders in Tradestation

Chapter 8 - Putting It All Together - What All Can You Do With Tradestation

Chapter 9 - Tradestation Vs The Competition

Chapter 10 - The Final Word On Tradestation

Chapter 1

What Is Tradestation Automated Software?

I'll keep it really simple here. Tradestation is a software tool to analyze and trade the markets (stock, futures, crypto, options, forex). This encompasses a lot of things - chart and indicator visualization, backtesting and strategy coding, and of course automated trading. Tradestation can be your one stop shop - market data, analysis tools and brokerage trading.

Tradestation is the leading software platform for the testing and automation of algorithmic trading strategies. Tradestation was one of the first trading software platforms available to the public (back when it was called Omega Research). With Tradestation you can build, test, deploy and automate just about any algo trading strategy you desire.

Even today, Tradestation continues to lead the pack with trading software. I have used it for over 15 years, and I still use it every single day. Tradestation is my preferred choice. And Tradestation is the preferred choice of my readers, too.

Tradestation is the leading software platform for the testing and automation of algorithmic trading strategies. Tradestation was one of the first trading software platforms available to the public (back when it was called Omega Research). With Tradestation you can build, test, deploy and automate just about any algo trading strategy you desire.

Even today, Tradestation continues to lead the pack with trading software. I have used it for over 15 years, and I still use it every single day. Tradestation is my preferred choice. And Tradestation is the preferred choice of my readers, too.

How Much Does Tradestation Cost?

Tradestation probably costs less than you think! This great software is included in many brokerage accounts at no cost, except for market data. A Tradestation rep (see my rep's contact info below) can can give all the details you need, but the costs to use this powerful software are pretty small relative to the trading systems you can create with it.

But as they say - "wait, it gets even better!"

KJ Trading Systems is proud to partner with TradeStation to offer you 100% reimbursement of the costs of the Strategy Factory Workshop through a special rebate plan.

Simply sign up for The Strategy Factory Workshop, fund a new account and receive a 20% rebate on all commission costs** – up to the full purchase price of my Strategy Factory workshop!

Yes, you read it correctly - my highly rated workshop, including one on one e-mail support from me, can be absolutely FREE after commission rebates!

NOTE - AS OF JANUARY, 2023, TRADESTATION IS OFFERING AN EVEN BETTER PROGRAM - 50% OFF BROKERAGE COMMISSIONS FOR LIFE! THIS PROGRAM MAY END AT ANY TIME, AND THEN THE 20% REBATE PROGRAM WILL STILL BE AVAILABLE.

Tradestation Rebate** – How It Works:

1. Sign up and pay for one of my upcoming workshops.

2. Click here to open a Tradestation account, with rebate already built in:

https://www.tradestation.com/promo/kjtrading/

Or this direct link:

https://getstarted2.tradestation.com/intro?offer=0122AFCO&sales_rep=palbino

3. Fund the account at Tradestation. If you are already a Tradestation client, check with our Tradestation rep listed below for eligibility.

4. Start collecting 20% commission rebates. These will be credited to your Tradestation account once per month, automatically.

5. Enjoy the rebates until the course fee is fully paid off!

That’s it! I have used the rebate program myself (to buy a trading computer), and I can confirm the rebate system works exactly as advertised.

**Valid while offer lasts. Some account exclusions may apply. Contact Kevin for more details. Tradestation is not available in all countries - check with Tradestation to ensure you can open an account where you live. Not all account types will qualify (please check with Tradestation first). If you are an existing Tradestation client, please check first with our Tradestation rep (contact info below) to see what rebates, if any, you may qualify for. Does not apply to "Tradestation's 1/2 price forever" promotion.

For more information about the reimbursement program or to get more details about TradeStation, please contact my Account Executive:

Peter Albino | Sr. Account Executive | TradeStation

120 S. Riverside Plaza, Suite 1650 | Chicago, IL 60606

Direct: (888) 735-1222 | Local: (312) 803-3860 |UK Phone (0808) 234-1049 x 3860 | Fax: (954) 652-5403

E-Mail: [email protected] | www.TradeStation.com

But as they say - "wait, it gets even better!"

KJ Trading Systems is proud to partner with TradeStation to offer you 100% reimbursement of the costs of the Strategy Factory Workshop through a special rebate plan.

Simply sign up for The Strategy Factory Workshop, fund a new account and receive a 20% rebate on all commission costs** – up to the full purchase price of my Strategy Factory workshop!

Yes, you read it correctly - my highly rated workshop, including one on one e-mail support from me, can be absolutely FREE after commission rebates!

NOTE - AS OF JANUARY, 2023, TRADESTATION IS OFFERING AN EVEN BETTER PROGRAM - 50% OFF BROKERAGE COMMISSIONS FOR LIFE! THIS PROGRAM MAY END AT ANY TIME, AND THEN THE 20% REBATE PROGRAM WILL STILL BE AVAILABLE.

Tradestation Rebate** – How It Works:

1. Sign up and pay for one of my upcoming workshops.

2. Click here to open a Tradestation account, with rebate already built in:

https://www.tradestation.com/promo/kjtrading/

Or this direct link:

https://getstarted2.tradestation.com/intro?offer=0122AFCO&sales_rep=palbino

3. Fund the account at Tradestation. If you are already a Tradestation client, check with our Tradestation rep listed below for eligibility.

4. Start collecting 20% commission rebates. These will be credited to your Tradestation account once per month, automatically.

5. Enjoy the rebates until the course fee is fully paid off!

That’s it! I have used the rebate program myself (to buy a trading computer), and I can confirm the rebate system works exactly as advertised.

**Valid while offer lasts. Some account exclusions may apply. Contact Kevin for more details. Tradestation is not available in all countries - check with Tradestation to ensure you can open an account where you live. Not all account types will qualify (please check with Tradestation first). If you are an existing Tradestation client, please check first with our Tradestation rep (contact info below) to see what rebates, if any, you may qualify for. Does not apply to "Tradestation's 1/2 price forever" promotion.

For more information about the reimbursement program or to get more details about TradeStation, please contact my Account Executive:

Peter Albino | Sr. Account Executive | TradeStation

120 S. Riverside Plaza, Suite 1650 | Chicago, IL 60606

Direct: (888) 735-1222 | Local: (312) 803-3860 |UK Phone (0808) 234-1049 x 3860 | Fax: (954) 652-5403

E-Mail: [email protected] | www.TradeStation.com

Do I Need A Large Account To Fund A Tradestation Account?

There are minimum account funding requirements, but they are pretty reasonable. You will want to ask your Tradestation rep for details.

One thing to beware of though - if you try trading with an underfunded account, you run a high chance of getting wiped out. It is called "Risk Of Ruin" and you need to avoid this!!

One thing to beware of though - if you try trading with an underfunded account, you run a high chance of getting wiped out. It is called "Risk Of Ruin" and you need to avoid this!!

Chapter 2

What Is A Tradestation Strategy?

Within the Trade Station software platform, the user can apply Tradestation strategies to a chart. These strategies control the buying and selling of the chart instrument. Many traders refer to these trading strategies as "algos" or "trading algorithms." The strategies are simply detailed rules for entering and exiting the market, and are created by the user. Tradestation also includes many strategies with the platform, and users can purchase or find 3rd party strategies on the Internet.

The premise behind Tradestation strategies is that the user will first properly test the strategy using historical data, to ensure profitability. This test is commonly referred to as a backtest.

It is possible to develop many Tradestation strategies that work. Yet, not every Tradestation strategy will be profitable in backtest. Plus, not every historically successful strategy will continue to be profitable in the future. There is a common saying in trading - "past performance is not indicative of future results." This is applicable to all Tradestation strategies.

I have been a proud user of Tradestation for over 15 years. Most of my Strategy Factory students also use Tradestation. It is the best software tool to help you develop automated and algorithmic trading strategies.

Here is a quick guide to some helpful Tradestation info, created by the folks at Tradestation: https://kjtradingsystems.com/tradestation-resources.html Tradestation Resources

The premise behind Tradestation strategies is that the user will first properly test the strategy using historical data, to ensure profitability. This test is commonly referred to as a backtest.

It is possible to develop many Tradestation strategies that work. Yet, not every Tradestation strategy will be profitable in backtest. Plus, not every historically successful strategy will continue to be profitable in the future. There is a common saying in trading - "past performance is not indicative of future results." This is applicable to all Tradestation strategies.

I have been a proud user of Tradestation for over 15 years. Most of my Strategy Factory students also use Tradestation. It is the best software tool to help you develop automated and algorithmic trading strategies.

Here is a quick guide to some helpful Tradestation info, created by the folks at Tradestation: https://kjtradingsystems.com/tradestation-resources.html Tradestation Resources

5 Ways To Utilize Tradestation Strategies For High-Growth Trading

Looking for the best Tradestation strategies? Whether you're a beginner or a seasoned trader, these tools and techniques can help you maximize your returns and stay ahead of the game. Find out which approaches work best with Tradestation and gear up for success.

Understand Market Movements and Use Technical Analysis

Technical analysis is an invaluable tool for Tradestation traders looking to profit from market movements. By examining past price and volume data, traders can observe trends and predict when prices are likely to rise or fall. Technical analysis can help you understand where markets are heading, when it’s time to enter or exit trades, and when to adjust your position size.

The point here is you will want to create strategies with Tradestation that take advantage of these market movements and technical anlaysis tools.

The point here is you will want to create strategies with Tradestation that take advantage of these market movements and technical anlaysis tools.

Utilize Automation to Maximize Efficiency and Minimize Risk

In a later chapter, we'll discuss more specifics of Tradestation automation. But for now...

Automation is becoming increasingly popular among Tradestation users, as it allows traders to maximize efficiency and minimize risk. Automated systems are designed to execute trades with no human input required – eliminating the potential for trader error. Automated systems can also track trends, detect when prices reach certain levels and automatically make decisions on entry / exit points based on pre-defined criteria.

Automated trading can help traders stay one step ahead of the markets, minimizing risks and optimizing returns.

Automation is becoming increasingly popular among Tradestation users, as it allows traders to maximize efficiency and minimize risk. Automated systems are designed to execute trades with no human input required – eliminating the potential for trader error. Automated systems can also track trends, detect when prices reach certain levels and automatically make decisions on entry / exit points based on pre-defined criteria.

Automated trading can help traders stay one step ahead of the markets, minimizing risks and optimizing returns.

Adopt a Plan-Based Approach to Trade Management

When it comes to managing your trades on Tradestation, the key is to adopt a plan-based approach. Start off by setting parameters for your trades and then determine when, where and how you will enter and exit each trade.

Once you have a plan in place, stick to it – no matter what! It’s also important to make sure that your risk management strategies are up-to-date by keeping an accurate record of each trade and taking regular emotional check-ins. This way, you can stay disciplined, focused on the bigger picture, and ultimately maximize returns with high-growth trading.

Once you have a plan in place, stick to it – no matter what! It’s also important to make sure that your risk management strategies are up-to-date by keeping an accurate record of each trade and taking regular emotional check-ins. This way, you can stay disciplined, focused on the bigger picture, and ultimately maximize returns with high-growth trading.

Set Appropriate Money-Management Guidelines

One of the most important strategies to succeed with high-growth trading on Tradestation is to set appropriate money management guidelines. This means understanding how much you can afford to invest in a single trade and how frequently you will enter and exit trades. For long-term growth, it’s important to know that there is no single right answer here – the key is to develop and stick to your own money-management plan for each trade.

Also, don’t forget about risk management. Diversify investments, track performance regularly, and take an emotion check when necessary.

Also, don’t forget about risk management. Diversify investments, track performance regularly, and take an emotion check when necessary.

Find and Utilize the Right Trading Tools

To get the most from your trading, you need to make sure you are using the right tools. Research various options and look for top-notch data analysis software with continuing support. It’s also important to make sure you understand software features and functions completely, so that you can take full advantage of them.

For example, Tradestation offers trading tools such as price charts, automated trading signals, real-time analytics tools and more so you can track your investment decisions in real time. Selecting appropriate free or paid charting services is also important to develop high-growth trading strategies.

For example, Tradestation offers trading tools such as price charts, automated trading signals, real-time analytics tools and more so you can track your investment decisions in real time. Selecting appropriate free or paid charting services is also important to develop high-growth trading strategies.

To be an effective trader, you need strategies for trading. You create strategies (algos) in Tradestation using their proprietary programming language called Easy Language. I describe that in the rest of this chapter. Later chapters will take the Easy Language you create, backtest algo strategies, and automate strategies for real time trading. Once you know Easy Language, you can also create indicators for visualization purposes. That is covered in Chapter XXXXX.

What Is Tradestation Easy Language?

Tradestation uses 2 languages to program strategies, Easy Language and Object Oriented Easy Language.

Most traders utilize what is called "Easy Language." Easy Language has been around since the inception of Tradestation, and includes many keywords, functions and capabilities today's algo trader needs. The best part about the language is that it truly is "easy." I'll show you some example below of how simple it really is.

The other Tradestation language is called Object Oriented Easy Language (OOEL), and has high powered capabilities that many modern programmers desire. OOEL expands the capabilities of Tradestation to new levels.

Most traders utilize what is called "Easy Language." Easy Language has been around since the inception of Tradestation, and includes many keywords, functions and capabilities today's algo trader needs. The best part about the language is that it truly is "easy." I'll show you some example below of how simple it really is.

The other Tradestation language is called Object Oriented Easy Language (OOEL), and has high powered capabilities that many modern programmers desire. OOEL expands the capabilities of Tradestation to new levels.

What Does An Example Tradestation Easy Language Strategy Code Look Like?

Here is how "easy" Easy Language is...

Let's say if the market closes at a 10 bar high close, you want to buy at the market at the next bar open. Conversely, if the market hits a 12 bar low close, you want to reverse and sell short.

Here is the Easy Language for that strategy:

if close=highest(close,10) then buy next bar at market;

if close=lowest(close,12) then sellshort next bar at market;

When you look at some other trading languages, you might have to write 10-50 lines of code to implement the same strategy. Truly "Easy Language!"

Obviously, the example is pretty simple, and you can create algos that are a lot more complicated. But even with those complicated algos, the programming platform commands and structure helps keep things simple for you.

The big benefit in this is that you do not have to spend time programming - you can spend time developing, building and testing strategies!

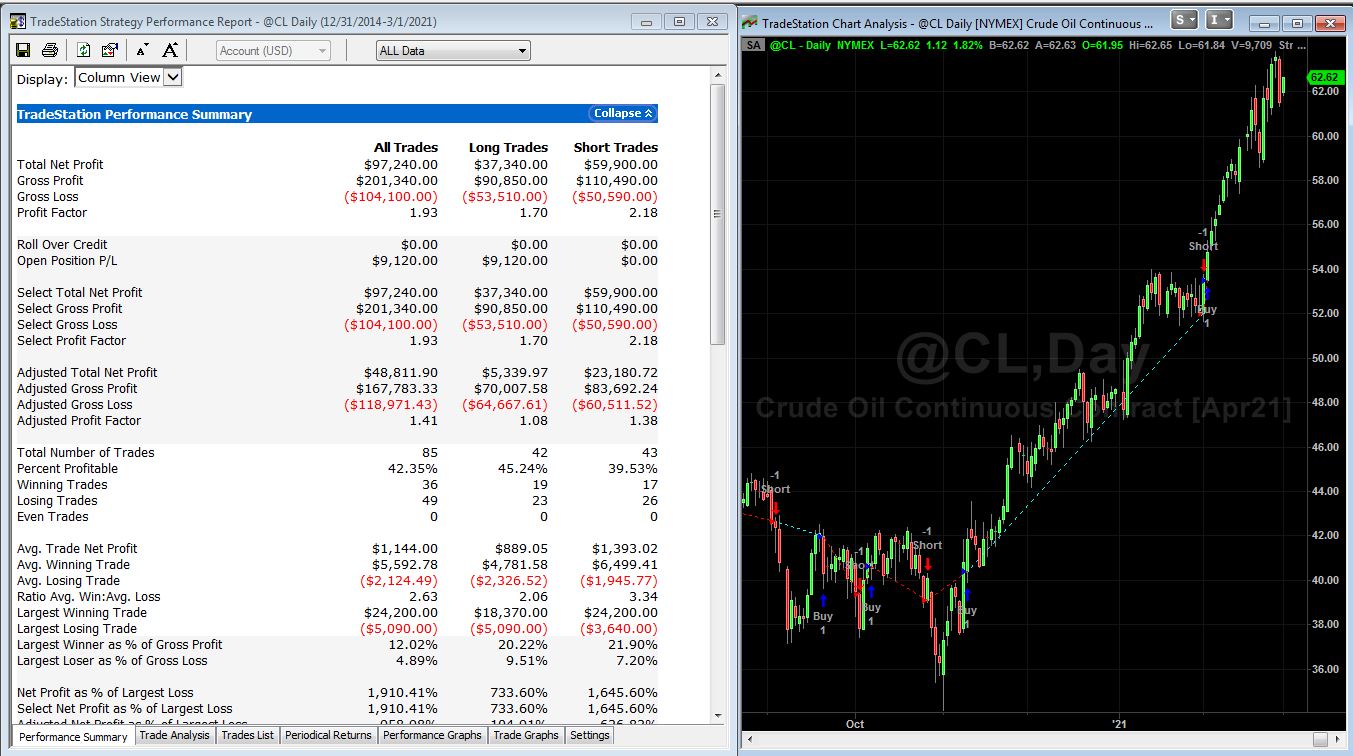

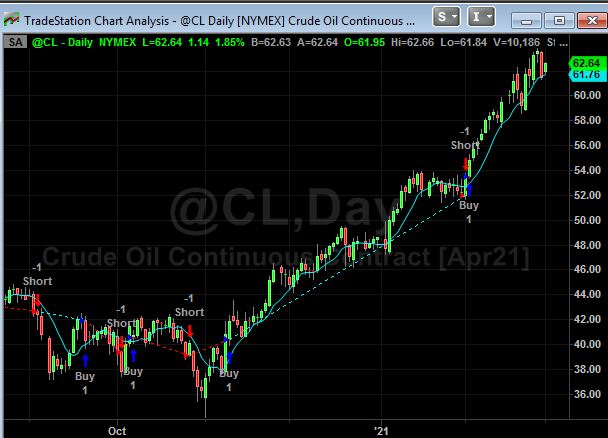

By the way, here is what the strategy above looks like for Crude Oil, which literally took me about 1 minute (with a 30 second break!) to code and create a Strategy Performance report for...

Let's say if the market closes at a 10 bar high close, you want to buy at the market at the next bar open. Conversely, if the market hits a 12 bar low close, you want to reverse and sell short.

Here is the Easy Language for that strategy:

if close=highest(close,10) then buy next bar at market;

if close=lowest(close,12) then sellshort next bar at market;

When you look at some other trading languages, you might have to write 10-50 lines of code to implement the same strategy. Truly "Easy Language!"

Obviously, the example is pretty simple, and you can create algos that are a lot more complicated. But even with those complicated algos, the programming platform commands and structure helps keep things simple for you.

The big benefit in this is that you do not have to spend time programming - you can spend time developing, building and testing strategies!

By the way, here is what the strategy above looks like for Crude Oil, which literally took me about 1 minute (with a 30 second break!) to code and create a Strategy Performance report for...

Do You Have Any Free Tradestation Algo Strategies For Easy Language?

Yes! If you want some free algo trading strategies - one that you could start trading today, just go here and sign up for my free newsletter. The Easy Language code is fully disclosed, and you can analyze it, modify it or do whatever you desire!

Also, check out my YouTube channel, where I show actual strategies and results:

Also, check out my YouTube channel, where I show actual strategies and results:

Can You Teach Me Tradestation Easy Language Programming

Of course! I teach the Easy Language programming you need to know in my Strategy Factory workshop.

Here is a video which describes my approach to Easy Language instruction in my course - Easy Language instruction and support is included at no additional cost.

Here is a video which describes my approach to Easy Language instruction in my course - Easy Language instruction and support is included at no additional cost.

In case you are wondering about the instruction I provide, here is the first video in my Easy Language Programming Module (25 video lessons):

Chapter 4

What Is Backtesting In Tradestation?

Everything You Need to Know About Backtesting With TradeStation

Backtesting your trading strategy is an essential step - discover how to do this using TradeStation. From setting up a strategy to gathering data and analyzing results, we cover it all in this chapter.

Backtesting is the process of testing a trading strategy on historical data to determine how well it would have performed in the past. By doing this, traders can estimate the profitability of their own strategies or evaluate and compare the performance of different strategies before making any live trades.

This process allows traders to gain insight into how their strategies could perform when used in real-time markets.

SIMPLY PUT: Backtesting is historically testing a strategy on market data. Tradestation makes it easy to do.

Here is a general outline of the steps you'll trade to backtest in Tradestation:

Backtesting is the process of testing a trading strategy on historical data to determine how well it would have performed in the past. By doing this, traders can estimate the profitability of their own strategies or evaluate and compare the performance of different strategies before making any live trades.

This process allows traders to gain insight into how their strategies could perform when used in real-time markets.

SIMPLY PUT: Backtesting is historically testing a strategy on market data. Tradestation makes it easy to do.

Here is a general outline of the steps you'll trade to backtest in Tradestation:

Gather Data to Test Your Strategy

The first step in backtesting your trading strategy is to gather the necessary data. You can access historical and intraday pricing data from most exchanges, giving you the information you need to design and test strategies with accuracy. You do this by calling up a chart, entering start and stop dates, and specifying the symbol.

With TradeStation’s powerful data integration technology, you can connect directly to a variety of sources of stock, futures and forex markets, or download data from another source in CSV format and import it into TradeStation.

With TradeStation’s powerful data integration technology, you can connect directly to a variety of sources of stock, futures and forex markets, or download data from another source in CSV format and import it into TradeStation.

The first step in backtesting your trading strategy is to gather the necessary data. You can access historical and intraday pricing data from most exchanges, giving you the information you need to design and test strategies with accuracy. You do this by calling up a chart, entering start and stop dates, and specifying the symbol.

With TradeStation’s powerful data integration technology, you can connect directly to a variety of sources of stock, futures and forex markets, or download data from another source in CSV format and import it into TradeStation.

With TradeStation’s powerful data integration technology, you can connect directly to a variety of sources of stock, futures and forex markets, or download data from another source in CSV format and import it into TradeStation.

Configuring Your TradeStation Strategies for Testing

Once you have all the necessary data, you can begin configuring your strategies for testing . You can use TradeStation’s extensive strategy library, a multitude of Internet sources of Tradestation strategies or other sources such as books to develop and optimize any type of trading strategy. Alternatively, you can also opt for a manual approach - using the Easy Language approach I described earlier.

The pre-built strategies already include conditions for entry and exits, and allow you to review both backtested and real-time performance results.

The pre-built strategies already include conditions for entry and exits, and allow you to review both backtested and real-time performance results.

Analyze Your Backtest Results in TradeStation

TradeStation offers advanced analysis features to allow you to explore your backtested results and compare hypothetical trades against actual historical data. You can view trade performance across different market environments, assess strategy performance, and evaluate how well it would have reacted to changes in the trading environment.

Ultimately, this analysis will help you identify strengths, weaknesses and any potential limitations in your strategy before investing any real money.

Ultimately, this analysis will help you identify strengths, weaknesses and any potential limitations in your strategy before investing any real money.

Optimize Your Strategies with TradeStation’s Optimization Tool

TradeStation’s Optimization Tool is an incredibly powerful tool that allows you to test different combinations of inputs and determine which variables produce the best performance over a given period of time. With this tool, you can tune your strategy for maximum gains and minimum drawdown. It also helps you identify potential risks in your strategy, such as margin requirements or commission costs, before relying on it in real-time trading.

Just be VERY careful with optimization. It is a tool that has misused by thousands of traders - including myself (long long ago!). My course will teach you the proper way to use optimization, which is a big part of developing good algorithmic strategies.

Just be VERY careful with optimization. It is a tool that has misused by thousands of traders - including myself (long long ago!). My course will teach you the proper way to use optimization, which is a big part of developing good algorithmic strategies.

Tradestation Backtesting - A Real World Example

OK, enough theory and explanations! Let's give a real world backtesting example, so you can see how "the rubber meets the road" - or as some people say "let's get down to brass tacks."

Imagine you have an idea for the markets. Let's say you notice that Gold tends to rise every Tuesday. You've seen this the past month, and it has risen consistently. So, you think this might be a nice trade to do on future Tuesdays.

But one month of results is pretty flimsy. That's where Tradestation can help. Using Tradestation Easy Language, you can easily program your "buy Tuesday" strategy, apply it to a chart of Gold, and in seconds you'll see how it has performed the past 1, 5, 10 or even 20 years!

You first set up a chart, with Gold for the last X years (whatever you choose).

You then create a strategy, using the language below.

Then you insert that strategy in a chart, and run the Strategy Performance report (shown below). Pretty simple!

Easy Language code:

If dayofweek(date)=1 then buy next bar at market; //buy market open on Tuesday

If dayofweek(date)=2 then sell next bar at market; //sell (exit) market open on Wednesday

What you have just done is backtested your strategy - you have performed an historical test of your algo, to see how it performed.

If it performed poorly over the test, you'd probably just throw it away. Why trade something that has not worked in the past?

On the other hand, if it performed well over your test period, you may decide it is worth trading. Now, just because it worked historically does NOT mean it will continue to perform, but if you learn a proper strategy building approach (like the approach I teach!) you can skew the odds of success in your favor a bit.

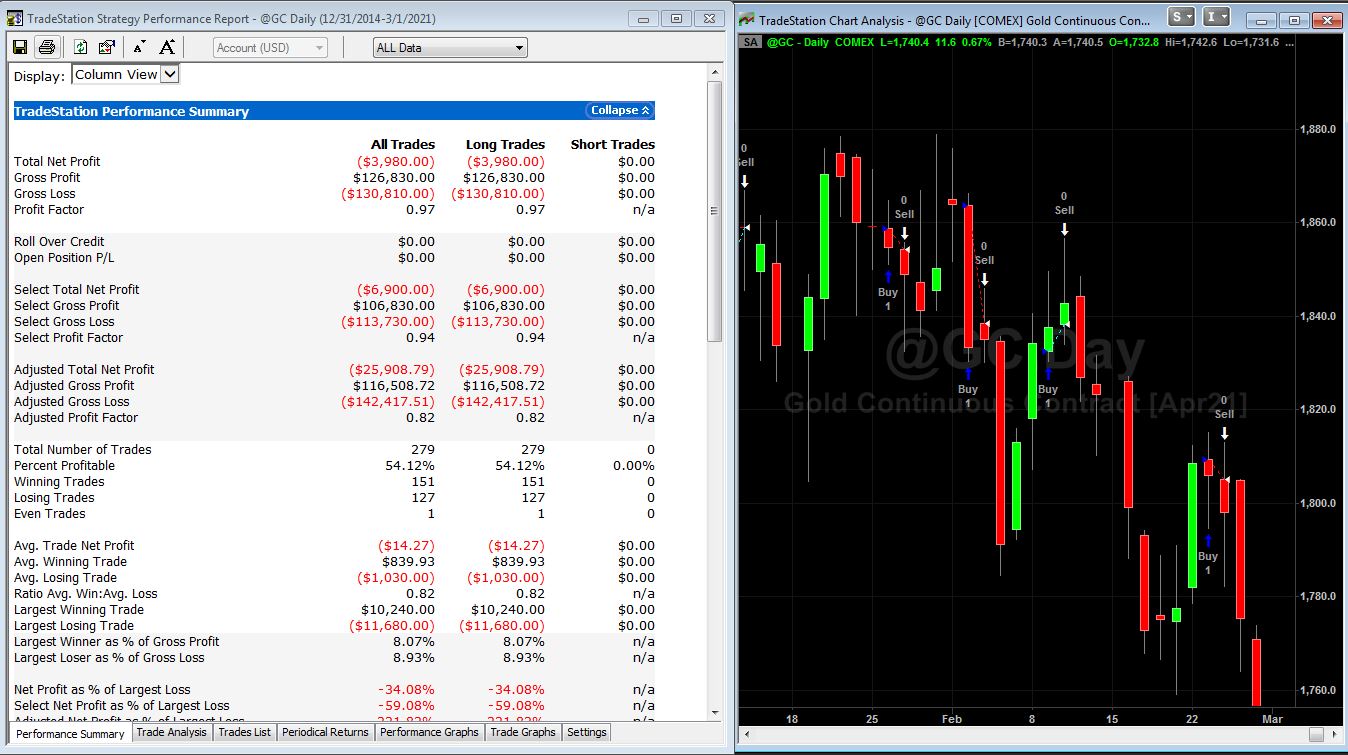

By the way, that buy Tuesday idea, sell Wednesday is not so hot for Gold:

Imagine you have an idea for the markets. Let's say you notice that Gold tends to rise every Tuesday. You've seen this the past month, and it has risen consistently. So, you think this might be a nice trade to do on future Tuesdays.

But one month of results is pretty flimsy. That's where Tradestation can help. Using Tradestation Easy Language, you can easily program your "buy Tuesday" strategy, apply it to a chart of Gold, and in seconds you'll see how it has performed the past 1, 5, 10 or even 20 years!

You first set up a chart, with Gold for the last X years (whatever you choose).

You then create a strategy, using the language below.

Then you insert that strategy in a chart, and run the Strategy Performance report (shown below). Pretty simple!

Easy Language code:

If dayofweek(date)=1 then buy next bar at market; //buy market open on Tuesday

If dayofweek(date)=2 then sell next bar at market; //sell (exit) market open on Wednesday

What you have just done is backtested your strategy - you have performed an historical test of your algo, to see how it performed.

If it performed poorly over the test, you'd probably just throw it away. Why trade something that has not worked in the past?

On the other hand, if it performed well over your test period, you may decide it is worth trading. Now, just because it worked historically does NOT mean it will continue to perform, but if you learn a proper strategy building approach (like the approach I teach!) you can skew the odds of success in your favor a bit.

By the way, that buy Tuesday idea, sell Wednesday is not so hot for Gold:

Of course, this is a really simple example. One feature you might want to add to that strategy is a stop loss. Like everything else with Tradestation, you can customize it to your desires. For instance, some people like dollar based stops, and some people like Average True Range based stops. I actually compare the two in this article.

Automated trading systems can help make the process of trading stocks and other financial instruments quick and efficient. With the right know-how, you can construct automated trading systems that are tailored to your goals and risk tolerance, allowing you to be a more successful trader. In this tutorial, we'll explore the fundamentals of automated trading systems and how best to take advantage of them.

Understand How Trading Systems Work

Before building an automated trading system, it's important to understand how trading systems work. Automated trading systems are designed to watch the market for signals that indicate when a trade should be made and then automatically execute the trade based on those signals. As a trader, you need to understand what factors influence these signals, such as price, volume, and technical data. Armed with this knowledge, you can construct automated rules around these indicators that can be used by your trading system to make decisions and take action.

With Tradestation, we will be automating the strategy we developed in the previous chapter.

With Tradestation, we will be automating the strategy we developed in the previous chapter.

Design the Architecture of Your Trades

Building automated trading systems requires an understanding of the various components that comprise a successful trading system. The architecture should include methods for collecting relevant data, creating signals, and executing trades. It must also incorporate risk management protocols to ensure your trades can survive losses and unexpected market movements.

When constructing the architecture of your trades, consider the strategies you are looking to implement – scalping, swing-trading, swing momentum plays etc. Once you have decided upon the setup, decide which signals need to be generated in order to trigger any orders. With this foundation set up, you will have defined the basis upon which your automated trading system operates.

Now, those last couple of paragraphs sound intimidating, I realize. But when you develop a strategy in Tradestation, place it on a chart and test it out, the automation of it (assuming you like the results) in pretty straightforward.

When constructing the architecture of your trades, consider the strategies you are looking to implement – scalping, swing-trading, swing momentum plays etc. Once you have decided upon the setup, decide which signals need to be generated in order to trigger any orders. With this foundation set up, you will have defined the basis upon which your automated trading system operates.

Now, those last couple of paragraphs sound intimidating, I realize. But when you develop a strategy in Tradestation, place it on a chart and test it out, the automation of it (assuming you like the results) in pretty straightforward.

Optimize Backtesting Processes and Strategies

In order to test the accuracy of your automated trading model, you must backtest and optimize it as much as possible. This process entails simulating past price movements to ascertain how well your trading strategy would have fared in different market environments. It also helps you understand what common patterns can help identify new opportunities.

When backtesting, consider factors such as capital available, frequency of trades and risk management measures. Utilize this data to design and tweak the parameters of your model before releasing it into real-time trading. By testing numerous software scenarios in a secure environment, you are more likely to develop a successful trading system that meets your criteria and goals.

When backtesting, consider factors such as capital available, frequency of trades and risk management measures. Utilize this data to design and tweak the parameters of your model before releasing it into real-time trading. By testing numerous software scenarios in a secure environment, you are more likely to develop a successful trading system that meets your criteria and goals.

Automate Execution of Strategies

Once your automated trading system is fully tested and ready to launch, it will execute trades at lightning speed when the right conditions are met. With automation in place, you can free up more time to explore other opportunities or simply relax knowing that your trading system is running efficiently. To automate the execution of your strategies, be sure to integrate tools such as algorithmic order entry and automated risk-management systems.

These enable you to define performance criteria before initiating a trade and constantly monitor any changes in market direction or sentiment. That way, you can quickly intervene if anything unexpected arises.

These enable you to define performance criteria before initiating a trade and constantly monitor any changes in market direction or sentiment. That way, you can quickly intervene if anything unexpected arises.

Incorporate Risk Management Techniques Into Strategy Builds

It’s important to consider risk management techniques when building automated trading systems. Risk management is the process of controlling your exposure to uncertainty, helping you make decisions with greater confidence. Strict risk management protocols should be followed in order to mitigate potential losses and maximize profits.

Automated risk-management systems can be used to detect highly volatile markets and low-linear instruments, ensuring that traders are aware of pending risks at all times. This can help you stay ahead of changes or sudden market movements that might otherwise lead to unexpected losses.

Automated risk-management systems can be used to detect highly volatile markets and low-linear instruments, ensuring that traders are aware of pending risks at all times. This can help you stay ahead of changes or sudden market movements that might otherwise lead to unexpected losses.

Automation In Tradestation - A Real Example

Now, I realize the last few sections sound a bit intimidating and scary. Of course, automating your trading is not a decision to be taken lightly!

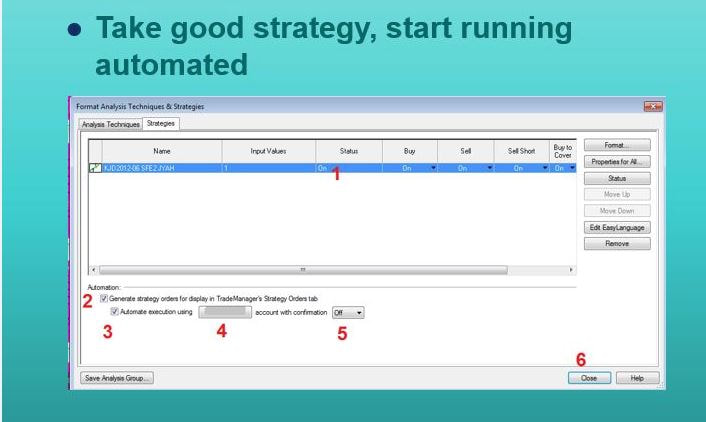

Let's say you have your fully tested strategy. To automate it in Tradestation, you must take the following steps.

Let's say you have your fully tested strategy. To automate it in Tradestation, you must take the following steps.

Step 1: Make sure the strategy status is "ON."

Step 2: Click the "Generate strategy orders..." box

Step 3: Click the "Automate execution..." box

Step 4: Select your Tradestation account number

Step 5: Select if you want confirmation on or off

Step 6: Click the Close button.

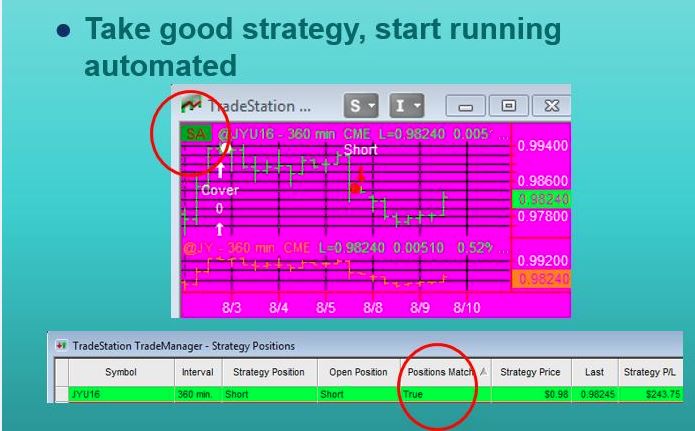

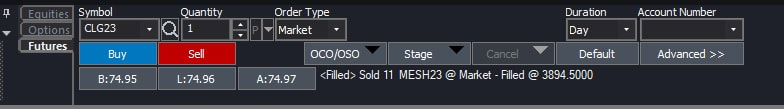

If you have done it correctly, you will see the following on the chart and in the Trade Manager:

Step 2: Click the "Generate strategy orders..." box

Step 3: Click the "Automate execution..." box

Step 4: Select your Tradestation account number

Step 5: Select if you want confirmation on or off

Step 6: Click the Close button.

If you have done it correctly, you will see the following on the chart and in the Trade Manager:

Chapter 6

What Is A Tradestation Indicator?

Up to this point, I've discussed Tradestation strategies - code that you can backtest and see performance statistics for. Plus, it is code you can automate to place trades for you.

Tradestation also allows you to program indicators. Indicators in Tradestation allow you to visualize patterns, averages, etc on a chart. Here is an example of a 8 bar moving average indicator on our Crude Oil chart.

Tradestation also allows you to program indicators. Indicators in Tradestation allow you to visualize patterns, averages, etc on a chart. Here is an example of a 8 bar moving average indicator on our Crude Oil chart.

Using Tradestation indicators, you can visualize many different concepts and calculations on a chart. This can help you understand what your strategies are doing, and can help you create better algo trading systems.

What Does An Example Tradestation Easy Language Indicator Code Look Like?

Here is the code for the moving average indicator:

Plot1(average(close,8),"Avg");

Notice the simplicity, once again, of Easy Language!

Plot1(average(close,8),"Avg");

Notice the simplicity, once again, of Easy Language!

Do You Have Any Free Tradestation Indicators?

I find Tradestation indicators to be a great help in visualizing certain market conditions. The cool is that there are different ways to depict what you want to see - you can paint bars, mark charts with dots and more - along with standard lines added to the chart.

Here are 4 from my personal library of indicators, I am pretty sure you will find them useful.

Here are 4 from my personal library of indicators, I am pretty sure you will find them useful.

Bollinger Band / Keltner Channel Combo

Here is an indicator that averages the popular Bollinger Band indicator with the also popular (but not as popular) Keltner channel. Using both as one indicator, you might get the best of both...

To create this in Tradestation, simply create a new indicator with this code:

inputs:

Length(20),NumDevs(1.5),NumATRs(2);

variables:

double Avg( 0 ),

double SDev( 0 ),

double LowerBand( 0 ),

double Shift(0),

double UpperBand( 0 );

Avg = Average( Close, Length ) ;

//Boll Bands

SDev = StandardDev( Close, Length, 1 ) ;

//keltner shift

Shift = NumATRs * AvgTrueRange( Length ) ;

UpperBand = (2*Avg + (NumDevs * SDev)+shift)/2 ;

LowerBand = (2*Avg + (NumDevs * SDev)-shift)/2 ;

Plot1( UpperBand, !( "UpperBand" ) ) ;

Plot2( LowerBand, !( "LowerBand" ) ) ;

Plot3( Avg, !( "MidLine" ) ) ;

To create this in Tradestation, simply create a new indicator with this code:

inputs:

Length(20),NumDevs(1.5),NumATRs(2);

variables:

double Avg( 0 ),

double SDev( 0 ),

double LowerBand( 0 ),

double Shift(0),

double UpperBand( 0 );

Avg = Average( Close, Length ) ;

//Boll Bands

SDev = StandardDev( Close, Length, 1 ) ;

//keltner shift

Shift = NumATRs * AvgTrueRange( Length ) ;

UpperBand = (2*Avg + (NumDevs * SDev)+shift)/2 ;

LowerBand = (2*Avg + (NumDevs * SDev)-shift)/2 ;

Plot1( UpperBand, !( "UpperBand" ) ) ;

Plot2( LowerBand, !( "LowerBand" ) ) ;

Plot3( Avg, !( "MidLine" ) ) ;

200 Bar Momentum

Here is a ShowMe indicator that depicts if the 200 bar momentum is up or down. Very useful for seeing longer term trends at a glance...

To create this in Tradestation, simply create a new ShowMe indicator with this code:

input:length(200); //momentum length

//momentum is up

Condition1 = close>close[length] ;

Value1 = CLOSE ;

if Condition1 then

begin

Plot1( Value1 ) ;

end ;

//momuentum is down

Condition2 = close<=close[length] ;

Value2 = CLOSE ;

if Condition2 then

begin

Plot2( Value2 ) ;

end ;

To create this in Tradestation, simply create a new ShowMe indicator with this code:

input:length(200); //momentum length

//momentum is up

Condition1 = close>close[length] ;

Value1 = CLOSE ;

if Condition1 then

begin

Plot1( Value1 ) ;

end ;

//momuentum is down

Condition2 = close<=close[length] ;

Value2 = CLOSE ;

if Condition2 then

begin

Plot2( Value2 ) ;

end ;

Outside Bar

Here is an indicator that shows outside bars. Outside bars can be used as turning points - breakouts above or below can be considered significant (but always test these first!)

To create this in Tradestation, simply create a new PaintBar indicator with this code:

Condition1 = h>h[1] and l<l[1];

Value1 = HIGH ;

Value2 = LOW ;

if Condition1 then

begin

PlotPaintBar( Value1, Value2,open,close,"Outside Bar",yellow ) ;

end ;

To create this in Tradestation, simply create a new PaintBar indicator with this code:

Condition1 = h>h[1] and l<l[1];

Value1 = HIGH ;

Value2 = LOW ;

if Condition1 then

begin

PlotPaintBar( Value1, Value2,open,close,"Outside Bar",yellow ) ;

end ;

Doji Bar

Here is an indicator that shows Doji bars, one of the most popular of Japanese candlestick patterns.

In the chart above, I mark Doji bars with a ShowMe indicator, and also a standard indicator. Code for both is below...

//Doji ShowMe

inputs: Percent( .20 ) ;

var: iDoji(0);

if AbsValue( O - C ) <= ( H - L ) * Percent * .01 then

iDoji = 1

else

IDoji = 0 ;

Condition1 = iDoji=1;

Value1 = CLOSE ;

if Condition1 then

begin

Plot1( Value1 ) ;

end ;

//**************************************

//Doji Indicator

inputs: Percent( .20 ) ;

var: iDoji(0);

if AbsValue( O - C ) <= ( H - L ) * Percent * .01 then

iDoji = 1

else

IDoji = 0 ;

Plot1( IDoji, "Plot1" ) ;

In the chart above, I mark Doji bars with a ShowMe indicator, and also a standard indicator. Code for both is below...

//Doji ShowMe

inputs: Percent( .20 ) ;

var: iDoji(0);

if AbsValue( O - C ) <= ( H - L ) * Percent * .01 then

iDoji = 1

else

IDoji = 0 ;

Condition1 = iDoji=1;

Value1 = CLOSE ;

if Condition1 then

begin

Plot1( Value1 ) ;

end ;

//**************************************

//Doji Indicator

inputs: Percent( .20 ) ;

var: iDoji(0);

if AbsValue( O - C ) <= ( H - L ) * Percent * .01 then

iDoji = 1

else

IDoji = 0 ;

Plot1( IDoji, "Plot1" ) ;

Do You Have Any More Free Tradestation Indicators?

Yes, here are some very useful indicators (ones I have on every automated chart I am running). The indicators in the articles are great when you are running strategies automated. Check it out!

Chapter 7

How Can I Enter Orders In Tradestation?

Take control of your trading experience with TradeStation's Quick Trade Bar. With up-to-date market data, key insights and time-saving tools, you can benefit from fast, effective decision making to unlock the power of the markets. Start taking advantage of opportunities today and get more out of your investments.

If you trade automated algos, most of your orders be automatically be placed. But occasionally, you will need to enter orders on Tradestation's Quick Trade Bar. Here is what it looks like:

If you trade automated algos, most of your orders be automatically be placed. But occasionally, you will need to enter orders on Tradestation's Quick Trade Bar. Here is what it looks like:

Tradestation Quick Trade Bar

Here are the steps to take, in Tradestation 10.0 Desktop Platform.

Log into your Tradestation Desktop Platform and bring up the Quick Trade Bar

Choose From Equities, Options or Futures Tab at left

Enter Symbol, Quantity, Order Type, Duration and Account Number

Enter Any Details for OCO/OSO order, and/or Staging

Double Check, Then Hit Appropriate Buy/Sell button

Log into your Tradestation Desktop Platform and bring up the Quick Trade Bar

Choose From Equities, Options or Futures Tab at left

Enter Symbol, Quantity, Order Type, Duration and Account Number

Enter Any Details for OCO/OSO order, and/or Staging

Double Check, Then Hit Appropriate Buy/Sell button

Can You Use Tradestation To Analyze The Markets?

Absolutely! Transform your trading with award-winning, fully customizable charting, back-testing and analysis capabilities for stocks, options, futures, crypto and forex. And stay up to the minute with TradeStation’s research and news capabilities.

Charting – Simply stunning charts — combined with the features and flexibility that serious traders need in an ever-changing market.

Strategy Back Testing and Optimization – Create, back-test and optimize your own custom trading strategy using on historical data and then analyze its performance to validate your trading ideas.

Walk Forward Optimizer – TradeStation’s new Walk Forward Optimizer aids in the mitigation of this problem by performing a set of “walk-forward” performance tests against as-yet-unseen market data, thereby simulating the unpredictability of trading a strategy under real market conditions.

OptionStation Pro – All-new OptionStation Pro is a fast, fluid and intuitive options trading platform from TradeStation. The more precisely you can visualize the options market, the more precisely you can execute. That’s why it’s packed with features like these:

Portfolio Maestro – If you trade multiple symbols and strategies, TradeStation Portfolio Maestro is a highly sophisticated tool that provides portfolio-level performance reporting, risk assessment and optimization for virtually any combination of symbols and strategies.

Research – The TradeStation Research Window, featuring Reuters fundamental data, gives you the tools to fully evaluate any equity. Check a stock’s valuation, profitability, financial strength, capitalization, and quarterly results. Plus, take a look at the industry comparison to measure the stock against its peers.

News – TradeStation’s News window gives you full-text news stories throughout the trading day – so you can stay on top of events that can influence stock prices and movements.

Strategy Back Testing and Optimization – Create, back-test and optimize your own custom trading strategy using on historical data and then analyze its performance to validate your trading ideas.

Walk Forward Optimizer – TradeStation’s new Walk Forward Optimizer aids in the mitigation of this problem by performing a set of “walk-forward” performance tests against as-yet-unseen market data, thereby simulating the unpredictability of trading a strategy under real market conditions.

OptionStation Pro – All-new OptionStation Pro is a fast, fluid and intuitive options trading platform from TradeStation. The more precisely you can visualize the options market, the more precisely you can execute. That’s why it’s packed with features like these:

Portfolio Maestro – If you trade multiple symbols and strategies, TradeStation Portfolio Maestro is a highly sophisticated tool that provides portfolio-level performance reporting, risk assessment and optimization for virtually any combination of symbols and strategies.

Research – The TradeStation Research Window, featuring Reuters fundamental data, gives you the tools to fully evaluate any equity. Check a stock’s valuation, profitability, financial strength, capitalization, and quarterly results. Plus, take a look at the industry comparison to measure the stock against its peers.

News – TradeStation’s News window gives you full-text news stories throughout the trading day – so you can stay on top of events that can influence stock prices and movements.

Can You Use Tradestation To Execute Trades?

Of course! There are quite a few ways to enter and track both simulated and real money account trades in Tradestation. With the software, you get professional-grade tools for placing trades – from stress-free simulated trading to the powerful, single-click Matrix trading and analysis window to fully automated trading.

Strategy and Trade Automation – With TradeStation Chart Analysis and RadarScreen, you can easily set your strategy or indicator to automate your trading thus reducing the delays that occur in discretionary manual market entry and exit. THIS IS WHAT I PRIMARILY USE AS AN ALGO TRADER.

Simulator – Test your trading ideas in real time in today’s market – without risking your own money

Matrix – Market-depth, advanced order entry, and order tracking – all in one window.

Order Bar – Trade any security – stocks, options, futures or forex – all through a single, intuitive interface

Chart Trading – TradeStation’s new Chart Trading feature allows discretionary traders to intuitively place and edit orders directly on a chart in real time.

Quick Trade Bar – The Quick Trade Bar is a simple, fast order-entry tool allowing you to interact with the current market more efficiently.

Market Depth – Place trades directly from the Market Depth display.

OptionStation Pro – All-new OptionStation Pro is a fast, fluid and intuitive options trading platform from TradeStation. The more precisely you can visualize the options market, the more precisely you can execute. That’s why it’s packed with features like these:

Basket Trading – Place a single order for an entire basket of stocks or futures.

TradeManager – Manage your positions like the professionals do – TradeManager lets you easily view and manage your orders and positions in real time.

TradeManager Analysis – An objective and balanced view of your trading performance, helping you to view trends and identify where you are strongest.

Trade Allocation Tool – Institutional traders and investment advisors can place equity trades and view and allocate them among client accounts within TradeStation.

Strategy and Trade Automation – With TradeStation Chart Analysis and RadarScreen, you can easily set your strategy or indicator to automate your trading thus reducing the delays that occur in discretionary manual market entry and exit. THIS IS WHAT I PRIMARILY USE AS AN ALGO TRADER.

Simulator – Test your trading ideas in real time in today’s market – without risking your own money

Matrix – Market-depth, advanced order entry, and order tracking – all in one window.

Order Bar – Trade any security – stocks, options, futures or forex – all through a single, intuitive interface

Chart Trading – TradeStation’s new Chart Trading feature allows discretionary traders to intuitively place and edit orders directly on a chart in real time.

Quick Trade Bar – The Quick Trade Bar is a simple, fast order-entry tool allowing you to interact with the current market more efficiently.

Market Depth – Place trades directly from the Market Depth display.

OptionStation Pro – All-new OptionStation Pro is a fast, fluid and intuitive options trading platform from TradeStation. The more precisely you can visualize the options market, the more precisely you can execute. That’s why it’s packed with features like these:

Basket Trading – Place a single order for an entire basket of stocks or futures.

TradeManager – Manage your positions like the professionals do – TradeManager lets you easily view and manage your orders and positions in real time.

TradeManager Analysis – An objective and balanced view of your trading performance, helping you to view trends and identify where you are strongest.

Trade Allocation Tool – Institutional traders and investment advisors can place equity trades and view and allocate them among client accounts within TradeStation.

Can You Use Tradestation To Customize My Algo Trading?

With Easy Language (which really is easy!) and the Strategy Network, you can produce your own trading strategies. Combined with the instruction I give you in the Strategy Factory Workshop, with Tradestation you will be on the road to developing your own way of hopefully defeating the markets!

You can do some neat things with the power of Tradestation, including esoteric concepts like equity curve trading. Whatever you can program, Tradestation can pretty much handle!

You can do some neat things with the power of Tradestation, including esoteric concepts like equity curve trading. Whatever you can program, Tradestation can pretty much handle!

Chapter 9

Tradestation Vs. The Competition

Tradestation Or NinjaTrader?

What's better, Tradestation or NinjaTrader? Well, I have owned both for many years, so I think I am in a unique position to comment on this.

First, I like Tradestation more, but a lot of that might be because I have used Tradestation so long, it just feels natural to me. It is great for building algo strategies quickly. NinjaTrader has its own programming language, which to me seems a lot more complicated, but it is very capable.

I heard it once described like this: "Tradestation was built by programmers for traders, and NinjaTrader was created by programmers for programmers."

Second, Tradestation can be free with a brokerage account, if you take enough trades per month or meet other requirements. NinjaTrader can be leased yearly or can be purchased for $1500 (at the time of writing) for a lifetime license.

Third, with Tradestation you are more or less tied to the Tradestation brokerage, not necessarily a bad thing. There are ways to send orders to non-Tradestation brokers, which is something I do. With NinjaTrader, there are a few brokerage choices, but you are encouraged to join Ninja's own brokerage.

I think you can succeed in algo trading with either platform. Many of my students use Tradestation, in part because of the terrific rebate program I have (detailed at top of page), but Ninja users can still build algo strategies using my Strategy Factory process and principles.

Just to give you a quick comparison of Tradestation versus Ninjatrader 8, here is an example from my "Entry and Exit Confessions" book.

***************************************************************************

Here is the strategy, in Tradestation Easy Language code:

Var: openloss(1000); //allowable loss per contract

if close<close[1] and (openpositionprofit<-openloss or marketposition=0) then sellshort next bar at market;

if close>close[1] and (openpositionprofit<-openloss or marketposition=0) then buy next bar at market;

***************************************************************************

Here is the same strategy, in NinaTrader8 code (translated by one of my students):

#region Using declarations

using System;

using System.Collections.Generic;

using System.ComponentModel;

using System.ComponentModel.DataAnnotations;

using System.Linq;

using System.Text;

using System.Threading.Tasks;

using System.Windows;

using System.Windows.Input;

using System.Windows.Media;

using System.Xml.Serialization;

using NinjaTrader.Cbi;

using NinjaTrader.Gui;

using NinjaTrader.Gui.Chart;

using NinjaTrader.Gui.SuperDom;

using NinjaTrader.Gui.Tools;

using NinjaTrader.Data;

using NinjaTrader.NinjaScript;

using NinjaTrader.Core.FloatingPoint;

using NinjaTrader.NinjaScript.Indicators;

using NinjaTrader.NinjaScript.DrawingTools;

#endregion

//This namespace holds Strategies in this folder and is required. Do not change it.

namespace NinjaTrader.NinjaScript.Strategies.KJTrading_Confessions

{

public class Entry01GoWithTheFlow : Strategy

{

protected override void OnStateChange()

{

if (State == State.SetDefaults)

{

Description = @"Entry #1 - Go With The Flow";

Name = "Entry01GoWithTheFlow";

Calculate = Calculate.OnBarClose;

EntriesPerDirection = 1;

EntryHandling = EntryHandling.AllEntries;

IsExitOnSessionCloseStrategy = true;

ExitOnSessionCloseSeconds = 30;

IsFillLimitOnTouch = false;

MaximumBarsLookBack = MaximumBarsLookBack.TwoHundredFiftySix;

OrderFillResolution = OrderFillResolution.Standard;

Slippage = 0;

StartBehavior = StartBehavior.WaitUntilFlat;

TimeInForce = TimeInForce.Gtc;

TraceOrders = false;

RealtimeErrorHandling = RealtimeErrorHandling.StopCancelClose;

StopTargetHandling = StopTargetHandling.PerEntryExecution;

BarsRequiredToTrade = 2;

// Disable this property for performance gains in Strategy Analyzer optimizations

// See the Help Guide for additional information

IsInstantiatedOnEachOptimizationIteration = false;

}

else if (State == State.Configure)

{

}

}

// NOTE: This code NOT OPTIMIZED to enhance readability

protected override void OnBarUpdate()

{

if (CurrentBar < BarsRequiredToTrade)

return;

// Variables

double openLoss = 100; // allowable loss per contract

if(Close[0] < Close[1] && ((Position.GetUnrealizedProfitLoss(PerformanceUnit.Currency) < -openLoss) || Position.MarketPosition == MarketPosition.Flat))

EnterShort();

if(Close[0] > Close[1] && ((Position.GetUnrealizedProfitLoss(PerformanceUnit.Currency) < -openLoss) || Position.MarketPosition == MarketPosition.Flat))

EnterLong();

}

}

}

********************************************************************************

So, the bottom line for me? I use both! I use Tradestation to develop strategies, I place many trades with Tradestation brokerage, BUT I also send Tradestation signals to NinjaTrader, which then pretty flawlessly sends orders to two different Ninja affiliated brokers. And I really like this setup!

First, I like Tradestation more, but a lot of that might be because I have used Tradestation so long, it just feels natural to me. It is great for building algo strategies quickly. NinjaTrader has its own programming language, which to me seems a lot more complicated, but it is very capable.

I heard it once described like this: "Tradestation was built by programmers for traders, and NinjaTrader was created by programmers for programmers."

Second, Tradestation can be free with a brokerage account, if you take enough trades per month or meet other requirements. NinjaTrader can be leased yearly or can be purchased for $1500 (at the time of writing) for a lifetime license.

Third, with Tradestation you are more or less tied to the Tradestation brokerage, not necessarily a bad thing. There are ways to send orders to non-Tradestation brokers, which is something I do. With NinjaTrader, there are a few brokerage choices, but you are encouraged to join Ninja's own brokerage.

I think you can succeed in algo trading with either platform. Many of my students use Tradestation, in part because of the terrific rebate program I have (detailed at top of page), but Ninja users can still build algo strategies using my Strategy Factory process and principles.

Just to give you a quick comparison of Tradestation versus Ninjatrader 8, here is an example from my "Entry and Exit Confessions" book.

***************************************************************************

Here is the strategy, in Tradestation Easy Language code:

Var: openloss(1000); //allowable loss per contract

if close<close[1] and (openpositionprofit<-openloss or marketposition=0) then sellshort next bar at market;

if close>close[1] and (openpositionprofit<-openloss or marketposition=0) then buy next bar at market;

***************************************************************************

Here is the same strategy, in NinaTrader8 code (translated by one of my students):

#region Using declarations

using System;

using System.Collections.Generic;

using System.ComponentModel;

using System.ComponentModel.DataAnnotations;

using System.Linq;

using System.Text;

using System.Threading.Tasks;

using System.Windows;

using System.Windows.Input;

using System.Windows.Media;

using System.Xml.Serialization;

using NinjaTrader.Cbi;

using NinjaTrader.Gui;

using NinjaTrader.Gui.Chart;

using NinjaTrader.Gui.SuperDom;

using NinjaTrader.Gui.Tools;

using NinjaTrader.Data;

using NinjaTrader.NinjaScript;

using NinjaTrader.Core.FloatingPoint;

using NinjaTrader.NinjaScript.Indicators;

using NinjaTrader.NinjaScript.DrawingTools;

#endregion

//This namespace holds Strategies in this folder and is required. Do not change it.

namespace NinjaTrader.NinjaScript.Strategies.KJTrading_Confessions

{

public class Entry01GoWithTheFlow : Strategy

{

protected override void OnStateChange()

{

if (State == State.SetDefaults)

{

Description = @"Entry #1 - Go With The Flow";

Name = "Entry01GoWithTheFlow";

Calculate = Calculate.OnBarClose;

EntriesPerDirection = 1;

EntryHandling = EntryHandling.AllEntries;

IsExitOnSessionCloseStrategy = true;

ExitOnSessionCloseSeconds = 30;

IsFillLimitOnTouch = false;

MaximumBarsLookBack = MaximumBarsLookBack.TwoHundredFiftySix;

OrderFillResolution = OrderFillResolution.Standard;

Slippage = 0;

StartBehavior = StartBehavior.WaitUntilFlat;

TimeInForce = TimeInForce.Gtc;

TraceOrders = false;

RealtimeErrorHandling = RealtimeErrorHandling.StopCancelClose;

StopTargetHandling = StopTargetHandling.PerEntryExecution;

BarsRequiredToTrade = 2;

// Disable this property for performance gains in Strategy Analyzer optimizations

// See the Help Guide for additional information

IsInstantiatedOnEachOptimizationIteration = false;

}

else if (State == State.Configure)

{

}

}

// NOTE: This code NOT OPTIMIZED to enhance readability

protected override void OnBarUpdate()

{

if (CurrentBar < BarsRequiredToTrade)

return;

// Variables

double openLoss = 100; // allowable loss per contract

if(Close[0] < Close[1] && ((Position.GetUnrealizedProfitLoss(PerformanceUnit.Currency) < -openLoss) || Position.MarketPosition == MarketPosition.Flat))

EnterShort();

if(Close[0] > Close[1] && ((Position.GetUnrealizedProfitLoss(PerformanceUnit.Currency) < -openLoss) || Position.MarketPosition == MarketPosition.Flat))

EnterLong();

}

}

}

********************************************************************************

So, the bottom line for me? I use both! I use Tradestation to develop strategies, I place many trades with Tradestation brokerage, BUT I also send Tradestation signals to NinjaTrader, which then pretty flawlessly sends orders to two different Ninja affiliated brokers. And I really like this setup!

Tradestation Or MultiCharts?

I own Tradestation and MultiCharts, so again I am in a good position to compare them. I should first mention I use them both everyday in live automated algo trading.

Next to Tradestation, MultiCharts is the 2nd most popular platform amongst my traders and followers.

First, Tradestation and MultiCharts languages are almost the same. Tradestation has Easy Language, MultiCharts has Power Language, and both are very compatible. They also both have higher level programming capabilities (OOEL and .NET).

Second, Tradestation can be free with a brokerage account, if you take enough trades per month or meet other requirements. MultiCharts can be purchased for $1500 (at the time of writing) for a lifetime license.

Third, with Tradestation you are more or less tied to the Tradestation brokerage, not necessarily a bad thing. There are ways to send orders to non-Tradestation brokers, which is something I do. With MultiCharts, there are a ton more brokerage choices. That is a nice thing!

Fourth, market data is built into Tradestation, where you need to subscribe to a data service with MultiCharts.

Finally, Tradestation is not available in Canada, Vietnam, parts of China and some other countries. MultiCharts is available in most of these "restricted" areas.

So, the final answer for me - Tradestation or MultiCharts - is both! Tradestation is my workhorse for sure, but I do use MultiCharts as a backup.

Next to Tradestation, MultiCharts is the 2nd most popular platform amongst my traders and followers.

First, Tradestation and MultiCharts languages are almost the same. Tradestation has Easy Language, MultiCharts has Power Language, and both are very compatible. They also both have higher level programming capabilities (OOEL and .NET).

Second, Tradestation can be free with a brokerage account, if you take enough trades per month or meet other requirements. MultiCharts can be purchased for $1500 (at the time of writing) for a lifetime license.

Third, with Tradestation you are more or less tied to the Tradestation brokerage, not necessarily a bad thing. There are ways to send orders to non-Tradestation brokers, which is something I do. With MultiCharts, there are a ton more brokerage choices. That is a nice thing!

Fourth, market data is built into Tradestation, where you need to subscribe to a data service with MultiCharts.

Finally, Tradestation is not available in Canada, Vietnam, parts of China and some other countries. MultiCharts is available in most of these "restricted" areas.

So, the final answer for me - Tradestation or MultiCharts - is both! Tradestation is my workhorse for sure, but I do use MultiCharts as a backup.

Chapter 10

The Final Word on Tradestation

WOW! We've made it to the end. As you can see, Tradestation has a lot to it - a lot of features and a lot of capabilities. There is a reason this software has been my primary development and trading tool for over 15 years.

Is Tradestation for you - only you can say for sure. Best rest assured, if you pick Tradestation as your trading platform, you'll be in good company. I use it as a Champion Trader, and so do most of my Strategy Factory students.

Thanks for reading, please leave your comments below!

Is Tradestation for you - only you can say for sure. Best rest assured, if you pick Tradestation as your trading platform, you'll be in good company. I use it as a Champion Trader, and so do most of my Strategy Factory students.

Thanks for reading, please leave your comments below!

HTML Comment Box is loading comments...

Award Winning Tradestation

Equities and equities options products and services are offered by TradeStation Securities, Inc. (Member NYSE, FINRA, NFA and SIPC). Forex products and services are offered by TradeStation Forex, a division of IBFX, Inc. (Member NFA). TradeStation Securities, Inc. and IBFX, Inc. are separate but affiliated companies.

TradeStation Group, Inc. is the parent company of five separate but affiliated operating subsidiaries, TradeStation Securities, Inc. (Member NYSE, FINRA, NFA and SIPC), IBFX, Inc. (Member NFA), IBFX Australia Pty Ltd, which is authorized and regulated by the Australian Securities and Investments Commission, TradeStation Technologies, Inc., a trading software and subscription company, and TradeStation Europe Limited, a United Kingdom, FSA-authorized introducing brokerage firm. None of these companies provides trading or investment advice, recommendations or endorsements of any kind. The information transmitted is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this in error, please contact the sender and delete the material from any computer. Forex products and services are offered by the TradeStation Forex divisions of IBFX, Inc. (Member NFA) and IBFX Australia Pty Ltd (ASIC registered).

Equities and equities options products and services are offered by TradeStation Securities, Inc. (Member NYSE, FINRA, NFA and SIPC). Forex products and services are offered by TradeStation Forex, a division of IBFX, Inc. (Member NFA). TradeStation Securities, Inc. and IBFX, Inc. are separate but affiliated companies.

TradeStation Group, Inc. is the parent company of five separate but affiliated operating subsidiaries, TradeStation Securities, Inc. (Member NYSE, FINRA, NFA and SIPC), IBFX, Inc. (Member NFA), IBFX Australia Pty Ltd, which is authorized and regulated by the Australian Securities and Investments Commission, TradeStation Technologies, Inc., a trading software and subscription company, and TradeStation Europe Limited, a United Kingdom, FSA-authorized introducing brokerage firm. None of these companies provides trading or investment advice, recommendations or endorsements of any kind. The information transmitted is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this in error, please contact the sender and delete the material from any computer. Forex products and services are offered by the TradeStation Forex divisions of IBFX, Inc. (Member NFA) and IBFX Australia Pty Ltd (ASIC registered).